About Genius One Fund

The Genius One Fund is NXUM Capital's flagship investment vehicle, structured to capitalize on the convergence of artificial intelligence, programmable finance, energy infrastructure, and critical materials.

Fund Overview

Investment Thesis

The global economy is entering a new phase defined by the synchronization of intelligence, energy, physical materials, and capital. We invest in the infrastructure of this next industrial cycle:

- AI & Compute Infrastructure - Hardware, data centers, and edge technologies enabling intelligent systems

- Programmable Finance - Stablecoin rails and tokenized liquidity for autonomous value transfer

- Energy & Grid Modernization - Generation, storage, and transmission powering automation

- Critical Materials - Securing supply chains for semiconductors, batteries, and advanced manufacturing

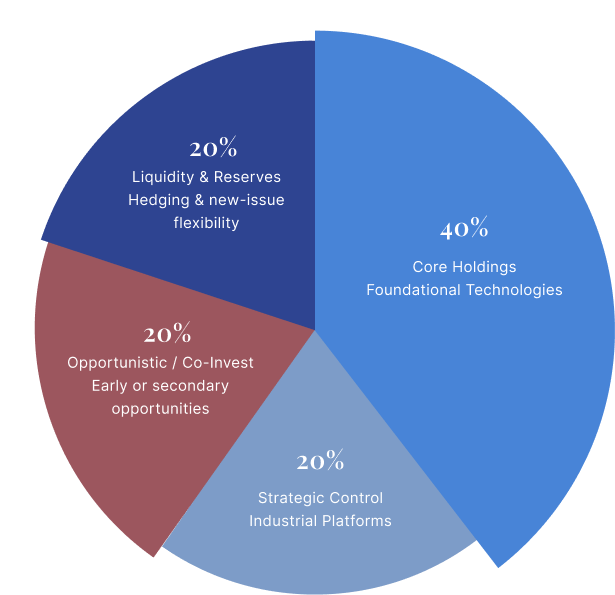

Fund Structure

Structured for Flexibility, Aligned for Performance

NXUM Capital is structured as a multi-sector, thesis-driven investment fund designed to capitalize on opportunities at the intersection of AI, blockchain, energy, and critical infrastructure.

Fund Economics

Institutional Economics with Frontier Exposure

| Metric | Target | Notes |

|---|---|---|

| Fund Size | $250-300 million | Scalable with co-investment capacity via SPVs |

| Preferred Return | 8% per annum | Prioritizes LP capital and income return |

| Target Net IRR | 22-28% | Driven by blended exposure across digital & physical sectors |

| Target MOIC | 2.5-3.5x | Net to LPs over a 6-7 year horizon |

| Management Fee | 2% on committed capital | Alignment-focused fee step-down |

| Carried Interest | 20% above preferred return | Standard two-tier waterfall (25% if over 3x) |

| Investment Period | 3 years | Followed by 3-4 year harvest period |

| Fund Life | 7 years + extensions | Standard private equity structure |

Return Drivers: Frontier access • Industrial cash flow • Cycle resilience • Exit path diversity

Investment Focus

We back the hard assets and systems enabling the next wave of automation and growth. Control of these inputs defines economic strength and national resilience.

AI Compute & Hardware

Distributed compute & robotics infrastructure, including edge processing clusters

- Data centers and compute infrastructure

- Semiconductor and chip technologies

- Edge computing and distributed systems

- AI hardware acceleration

Programmable Finance & Digital Assets

Stablecoin rails & tokenized liquidity (e.g., Tether & institutional settlement)

- Regulated stablecoin infrastructure

- Programmable money and smart contracts

- Digital asset custody and settlement

- Tokenization platforms

Energy & Data Infrastructure

Generation, storage, transmission, data centers, grid modernization

- Clean energy generation

- Energy storage solutions

- Grid modernization and transmission

- Data center power infrastructure

Critical Minerals & Materials

Semiconductors, raw materials, and batteries for compute and electrification

- Rare earth elements and critical minerals

- Advanced materials (carbon black, graphene)

- Battery technology and materials

- Circular economy and waste-to-value

NXUM's strategy aligns with where technological innovation and strategic independence converge. We invest where intelligence, energy, and capital systems intersect.